Smaller EMIs

Minimum Loan Amount Rs. 3 Lakhs

No PrePayment Charges

Floating & Fixed Interest Rates

Home Loan

Achieve your dream of homeownership with an Axis Bank Home Loan, starting from Rs. 3,00,000. This loan includes benefits like lower EMIs due to extended repayment periods, competitive interest rates, a straightforward application process, and doorstep service, among others. Find out more about the Axis Bank Home Loan now.

Home Loan Details

| Loan Amount | Up to Rs 5 crore |

| Loan Tenure | Up to 30 years |

| Floating Interest Rate | 8.75% - 9.15% |

| Fixed Interest Rate | 14% |

| Processing Fee | Up to 1% of the loan amount +GST (minimum Rs 10,000) |

Features and Benefits

Avail attractive interest rates

Enjoy more affordable home loans with appealing interest rates each month.

Choose your interest rate type

Approval of loans is at the discretion of Axis Bank and is subject to its terms and conditions as well as compliance with the regulatory requirements set by the government and the Reserve Bank of India (RBI). Please be aware that merely submitting the required documents does not guarantee loan approval, which will depend on meeting the bank's criteria. Axis Bank does not take responsibility for the accuracy of the images used. Agents may be utilized for the sales, marketing, and promotion of its products. The RBI does not maintain personal accounts for individuals or public trusts. Beware of fraudulent offers made via phone or email in the name of the RBI.

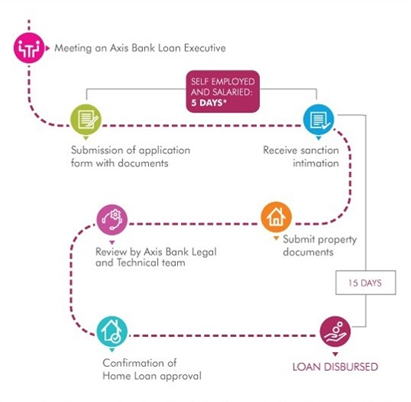

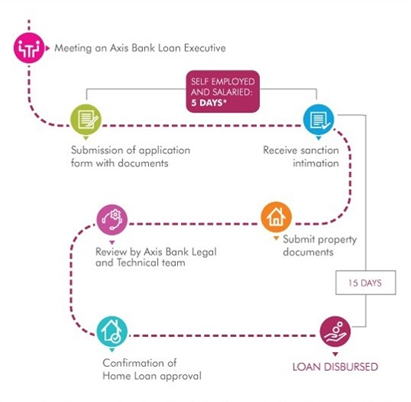

Application process

Before

you apply for a home loan, you can check your home loan

eligibility here.

Before

you apply for a home loan, you can check your home loan

eligibility here.

Transfer loan balance with ease

Transfer your existing home loan to Axis Bank, without any hassles.

Get service at your doorstep

Avail or repay the home loan from the comfort of your home or office.

Pay no prepayment charges

No prepayment charges for paying off your home loan before the due date (only for loans availed at floating rate of interest)

Be assured of quick, transparent processing

Premium banking customers can contact their Relationship Manager for details of special benefits.

Repay your loan over a longer tenure

Repay your home loan in smaller EMIs, over a longer tenure, depending on the situation of your finances.

Application process

Before

you apply for a home loan, you can check your home loan

eligibility here.

Before

you apply for a home loan, you can check your home loan

eligibility here.

Also, just to get an estimate of your loan amount you can use Axis Bank’s EMI Calculator for home loans.

Please be aware that merely submitting the required documents does not guarantee loan approval, which will depend on meeting the bank's criteria. Axis Bank does not take responsibility for the accuracy of the images used. Agents may be utilized for the sales, marketing, and promotion of its products. The RBI does not maintain personal accounts for individuals or public trusts. Beware of fraudulent offers made via phone or email in the name of the RBI. A Home Loan not only helps you purchase residential property but also helps in asset building and provides tax benefits. Typically, you need to pay up to 20% of the property’s cost from your own funds. The loan amount can be repaid over a chosen period, with both the principal and interest payments qualifying for tax deductions under the Income Tax Act.

Tips to keep in mind while applying for a home loan

Please be aware that merely submitting the required documents does not guarantee loan approval, which will depend on meeting the bank's criteria. Axis Bank does not take responsibility for the accuracy of the images used. Agents may be utilized for the sales, marketing, and promotion of its products. The RBI does not maintain personal accounts for individuals or public trusts. Beware of fraudulent offers made via phone or email in the name of the RBI. A Home Loan not only helps you purchase residential property but also helps in asset building and provides tax benefits. Typically, you need to pay up to 20% of the property’s cost from your own funds. The loan amount can be repaid over a chosen period, with both the principal and interest payments qualifying for tax deductions under the Income Tax Act. Home Loans can be applied for at a bank branch, loan processing centre, or online. Consider these tips when applying for a home loan:

Lorem ipsum

Evaluate how much you can afford in monthly EMIs, considering all your expenses, including any existing loans and credit card debts. Generally, banks allow EMIs to constitute up to 40% of your net monthly income.

Lorem ipsum

Applying for a loan amount higher than your eligibility might lead to rejection. Once you know your eligible amount, you can plan your down payment accordingly.

Lorem ipsum

Applying at a bank with which you have existing relationships, like a savings or salary account, might ease the KYC process, as the bank already has some of your financial information.

Lorem ipsum

Banks often favour customers with good repayment records and high credit scores, potentially offering quicker loan approval, more flexible repayment options, or reduced processing fees.

Lorem ipsum

Ensure the property you are buying has all necessary regulatory and environmental clearances, or check if it’s listed as approved by your bank to facilitate faster loan approval.

Lorem ipsum

If your income does not qualify you for the desired loan amount, consider a joint loan with a family member. Opting for a longer repayment term can reduce your monthly EMI and ease your financial burden.

Dos and Don’ts while applying for a home loan

Do’s

Do your research about the home-property price, builder’s background, clearances for the project, etc. Also do your research about the home loan - interest rate, processing charges, repayment schedule, etc

Know the amount you have to pay such as down payment amount, processing charges, stamp duty, registration fees and make provision for the same

Ensure all documents are in place – salary slips, Income Tax Returns, property agreement, and registration, etc

Take time to improve your credit history, if required before you apply for a home loan as there are chances that the bank may offer you better terms and conditions

Dont’s

Don’t apply for loans on multiple aggregator websites as it indicates you are loan hungry and may reduce the chances of your application being approved

Don’t take too many loans before you apply for a home loan-such as a personal loan or auto loan. As home loan amounts are big-ticket loans this will impact your eligibility.

Don’t go overboard with your credit card spends and don’t delay your loan repayments as this will impact your credit score negatively

Don’t take a huge loan as you may find it difficult to repay. Affordability is key when it comes to home loan

How to apply for a Home Loan

New to bank

Existing to bank

How to Apply?

Follow this step-by-step guide when applying for a housing loan from Axis Bank

- 01

Application procedure

Complete the Housing Loan application with accurate personal, employment, and financial details.

- 02

Processing fee

Remit the processing fee to commence validating your application.

- 03

Financial review

Engage with the bank to clarify Home Loan terms based on your financial profile.

- 04

Digital application

Utilise the online platform to submit documents for a Home Loan application.

- 05

Loan evaluation

The bank assesses your application in line with its credit policies.

- 06

Loan sanction

Receive a detailed sanction letter post-approval outlining loan specifics.

- 07

Property scrutiny

Undergo property inspection for legal and valuation compliance.

- 08

Disbursement

The loan is disbursed on positive verification, enabling your property investment.

Home Loan Fees and Charges

Depending on the type of housing loan you apply for, you will have to pay various charges, including:

1. Processing fee : This is one of the essential home loan fees to be paid to the bank by the borrower after the approval of the loan application. It is a one-time non-refundable fee. The processing fee will become up to 1% of the loan amount

2. Prepayment charges : If you decide to repay the home loan amount before the loan tenure ends, you will have to pay a prepayment penalty.

3. Conversion fee : A conversion fee is charged when you decide to convert to a different loan scheme for the purpose of reducing the interest rate attached to your current loan scheme.

4. Home insurance : It is vital to have an ongoing insurance policy throughout the housing loan tenure. You need to pay the premium for the insurance plan directly to the company offering the service.

5. Cheque dishonour charges : If a cheque you issue to pay the home loan EMI is dishonoured due to insufficient account balance or any other reason, cheque dishonour charges are levied.

6. Default charges : If you fail to pay your EMIs on time, you will be charged home loan fees as a penalty for delayed payments.

7. Change in loan term : You may have to pay nominal charges if you decide to change your loan tenure.

Types of Home Loans in India

Home Loans serve various purposes beyond just purchasing a residence.

1. New Home Loans: For first-time property buyers meeting specific eligibility criteria.

2. Pre-approved Home Loans:: Based on a preliminary assessment of a borrower’s financial health and credit standing.

3. Home Purchase Loans:: Specifically for buying a house or apartment.

4. Construction Loans:: For building a house on owned land.

5. Renovation Loans:: For existing homeowners looking to upgrade or extend their homes.

6. Plot Loans: : For buying land to construct a house.

7. Home Loan Top-Up: Allows borrowing additional funds on an existing home loan.

8. Balance Transfer Home Loan: This enables transferring existing home loans to another lender for better interest rates. Your ability to repay is a critical factor in the approval or rejection of a Home Loan. Before applying, review your credit report and score.

What to do if your Home Loan application is rejected?

If your home loan application is rejected, you can re-apply for the home loan. But you must consider the following aspects before you proceed:

- Credit score: Your credit score is a vital determinant of your capacity to repay a loan. Housing loans are long-term loans. Your ability to repay is a critical factor in the approval or rejection of a Home Loan.

A poor credit score increases the chances of your home loan application getting rejected. Your ability to repay is a critical factor in the approval or rejection of a Home Loan. Before applying, review your credit report and score. - Loan Amount: Some borrowers apply for a loan amount that is way beyond their eligibility. Paying off debts can improve your score and enhance loan eligibility.

- Other Ongoing Loans: Your loan application can also get rejected if you are already repaying some ongoing loans. To get loan approval, you must not be paying more than 50% of your monthly income towards loan repayments. Having many loans will have a detrimental effect on your personal finances and also your repayment capacity. Thus, you should clear any ongoing loans before applying for a housing loan.

Home Loan Balance Transfer

A home loan balance transfer helps you avail of lower home loan interest rates.Paying off debts can improve your score and enhance loan eligibility. Banks determine the maximum loan amount based on your current monthly income. If a loan is denied because it exceeds your qualifying amount, consider reapplying after lowering the requested amount. As interest rates drop, refinancing could lead to lower EMIs and substantial interest savings.

Benefits of Home Loan Balance Transfer

- Hassle-free processing : Transferring a home loan is hassle-free. The eligibility criteria of the process are simple and require minimal documentation.

- Customised repayment options : Applicants can enjoy tailored repayment options to keep the housing loan affordable. With a lower interest rate, borrowers can either choose to enjoy lower EMIs or a shorter tenure.

- Affordable interest rates : If you’re paying above-market rates, transferring your home loan could be financially beneficial. Utilise the Home Loan balance transfer option to refinance your mortgage at reduced interest rates, leading to lower monthly payments and increased savings.

- Alter the home loan tenure : When you transfer a home loan, you can choose to restructure loan terms and change the home loan tenure or the repayment period as per your financial capabilities.

- Top-up loan : A home loan balance transfer comes with the benefit of a sizeable top-up loan that offers a relatively lower interest rate compared to personal loans.

How to Improve Your Chances of Getting a Home Loan?

To increase your chances of getting a housing loan approved, here’s what you can do.

To increase your chances of getting a housing loan approved, here’s what you can do.

1. Credit clean-up : Your credit score is a vital factor of consideration. A high credit score makes it easier for you to get a loan. If you have a low credit score, identify the reasons by checking your credit report. Sometimes, minor errors affect your credit score adversely. In such a case, inform Credit Information Bureau (India) Limited (CIBIL) immediately about the error.

2. Assess your debt-to-income ratio : Lenders analyse your current income to determine your ability to pay the home loan EMIs. If possible, you can try to increase your annual income through a part-time job or by selling liquid assets like stocks. As your debt-to-income ratio increases, your chances of getting a loan can also increase.

3. Limit your borrowing : If you borrow more money than you need to meet your financial targets, your chances of getting a housing loan are reduced. Save and invest more, and take wise calls on how much money you require as a loan and submit an application for that particular amount.

4. Add a co-signor or guarantor : In certain cases, it can be difficult to get a loan on your own accord. Consider adding a co-signor or guarantor with a good credit score. A co-signor or guarantor ensures that you pay your home loan EMIs on time, and if you fail to do so, they are liable to repay the loan on your behalf. However, getting a co-signor or guarantor comes with its own terms and conditions and so be sure to take note of the same.

Get Home Loan for Different budgets

Review the associated fees and charges to make an informed decision.

Eligibility Criteria & Documents Required for Home Loan

Embarking on the journey to homeownership begins with understanding the documents required for Home Loan. By preparing your Home Loan documents meticulously, you set the stage for a straightforward and efficient loan application process.

Eligibility Criteria

Salaried individuals eligible for Home Loans

For salaried individuals, securing a Home Loan requires a stable employment history, typically within government sectors or reputed companies. Applicants must be over 21 and not above 65 years or the age of retirement by the loan's end. Ensure a thorough check of your documents required for Home Loan, including employment verification and financial stability proofs, as it is the key to a successful application.

Professionals eligible for Home Loans

Professional applicants, such as doctors or engineers, are welcome to apply by Axis Bank for a Home Loan. The age limit is between 21 and 65 years. The Home Loan documents list extends to professional qualifications and proof of practice for these applicants to ensure credibility and a reliable repayment structure.

Self-employed individuals eligible for Home Loan

Self-employed business owners and entrepreneurs looking to invest in property must ensure comprehensive documents required for a Home Loan application, showcasing consistent income through tax returns. Eligibility hinges on being over 21 at loan initiation and under 65 at loan closure, with a strong financial record to support the application.

Home Loan borrowing limits

The minimum Home Loan amount starts at ₹3 lakh.

Margins

Axis Bank stipulates varying margins for different Home Loan brackets. Loans up to ₹30 lakh require a 10% margin. For amounts extending from ₹30 lakh to ₹75 lakh, the margin is 20%. For Home Loan above ₹75 lakh, borrowers must maintain a 25% margin. These thresholds ensure financial prudence and loan affordability tailored to the borrower's needs.

Submit the documents listed below and get a Home Loan in 5 days!

Go through the Home Loan documents checklist to ensure a smooth and speedy sanction:

| Document Category | For Salaried Individuals | For Self-Employed Individuals | For Partners/Directors in Firms |

|---|---|---|---|

| Mandatory Documents | Application Form, PAN Card | Application Form, PAN Card | Application Form, PAN Card |

| Proof of Identity | Passport, Aadhaar Card, Driving License, Voter ID, Govt Employee ID | Passport, Aadhaar Card, Driving License, Voter ID, Govt Employee ID | Passport, Aadhaar Card, Driving License, Voter ID, Govt Employee ID |

| Proof of Address | Aadhaar Card, Voter ID, Driving License, Govt Employee ID, Utility Bills | Aadhaar Card, Voter ID, Driving License, Govt Employee ID, Utility Bills | Aadhaar Card, Voter ID, Driving License, Govt Employee ID, Utility Bills |

| Date of Birth Proof | PAN Card, Aadhaar Card with DOB, Driving License, Birth Certificate, SSC Marksheet | PAN Card, Aadhaar Card with DOB, Driving License, Birth Certificate, SSC Marksheet | PAN Card, Aadhaar Card with DOB, Driving License, Birth Certificate, SSC Marksheet |

| Signature Proof | Passport, PAN Card, Banker’s Verification, Notarised Affidavit | Passport, PAN Card, Banker’s Verification, Notarised Affidavit | Passport, PAN Card, Banker’s Verification, Notarised Affidavit |

| Other Important Documents and Checks | - Aadhaar card is mandatory - PAN card - Passport-size photograph - Proof of Residence for all individuals | - Aadhaar card is mandatory - PAN card - Passport-size photograph - Proof of Residence for all individuals | - Aadhaar card is mandatory - PAN card - Passport-size photograph - Proof of Residence for all individuals |

Based on the borrower the proof of income varies as follows:

For Salaried Individuals:

- 3 months' pay slip

- 6 months' pay slip with bonus

- 6 months bank statements

- 2 yrs Form 16

- 3-month job appointment letter

- Appointment letter/contract letter

- Continuous Discharge Certificate

- Overseas credit report

- Valid visa/copy/OCI card

- Passport copy

- POA details

For Self-employed individuals:

- 2 yrs ITR with Computation of Income

- P&L, Balance Sheet with CA Seal and Sign

- Tax Audit Report (if Gross Turnover exceeds ₹1 Cr or Gross Receipts exceed ₹25 Lakh)

- 6 months bank statements

- ITR filings with digital sign

- CPC and tax paid challan

For Partners/Directors in Firms

- Partnership Deed, List of Partners

- NOC as per Axis Bank format

- Financials with audited ITR

- Partnership authority letter

- Board Resolution (for Companies)

- Articles of Incorporation, MOA and AOA

- DIN of all Directors, Board Resolution

- Company Share Holding Pattern

Additional Requirements:

- For Balance Transfer/Takeover of Loan from other bank/financial institution: Provide 12 months' bank statement with the latest outstanding letter and 6 months' statement from where EMI is deducted.

- For Lease Rental Discounting: Submit 6 months' bank statement where rent is credited, registered lease agreements, and 2 years ITR with computation of income.

Documents to be submitted before loan disbursement

Axis Bank ensures a secure and transparent loan disbursement process, necessitating the submission of specific documents and adherence to certain checks and controls. Below is list of the essential documents required for Home Loan:

Interest Rates on Home Loans

Axis Bank offers competitive Housing Loan interest rates, ensuring affordability across professions.

Salaried

8.75 p.a.

Self Employed

9.1 p.a.

SIP Calculator

Systematic Investment Plan (SIP) allows you to make small investments at regular intervals to help you achieve your dreams. Axis Bank offers its customers the choice to start a SIP in mutual fund schemes of 20 Asset Management companies (AMCs).

Your total wealth is

₹49,46,277

You are eligible for up to

₹ 15,00,000

Home Loan FAQs

A Home Loan Equated Monthly Instalment (EMI) is your regular payment towards the borrowed amount, divided into principal and interest components. Calculated from the loan's principal, interest rate, and tenure, the EMI ensures a steady reduction in your loan balance. For seamless management, it's deducted from your savings account. Adjusting the EMI or loan tenure may be necessary if interest rates change, ensuring consistency in repayment when you apply for a Home Loan.

Various Home Loan options are available to suit different housing needs. These include:

- Standard Home Loans for buying a residence.

- Land Purchase Loans for acquiring a plot.

- Construction Loans for building a home.

- Home Improvement Loans for renovation projects.

- Top-up Loans for additional funding on existing loans.

- Balance Transfer Loans to switch lenders for better terms.

- Pre-approved Home Loans for quicker loan processing.

Initiate your Axis Bank Home Loan application by completing the formonline or at the branch or loan or at any Axis Bank branch. Submit your application along with the requisite KYC documentation. Post sanction, provide the necessary property documents. Following document verification and property appraisal, the loan approval and disbursement occurs within 15 days, subject to accurate and complete documentation.

Applying for a Home Loan online offers significant benefits, streamlining the application process. This saves time, simplifies comparisons of loan options, and calculates eligibility and EMIs instantly. The digital platform ensures a smooth customer experience, removing the need to visit a branch and facilitating a hassle-free and efficient loan application journey.

Principal repayment qualifies for a deduction up to ₹1.5 lakh under Section 80C. Interest payment offers a deduction up to ₹2 lakh per annum under Section 24(b). Additional deductions up to ₹1.5 lakh for loans under the affordable housing segment as per Section 80EEA, subject to certain conditions. Do note that Section 80EEA benefits are not applicable for home loans taken post March 31, 2022.

It is permissible to have multiple Home Loans concurrently, subject to certain conditions:

- No legal restrictions on holding more than one Home Loan.

- Approval is contingent on satisfying the lender’s eligibility criteria.

- The borrower must demonstrate adequate repayment capacity.

A Home Loan is secured to finance the purchase or construction of property, with the property itself serving as collateral. In contrast, a mortgage refers to a loan secured by property already owned, often bearing higher interest rates. Both involve pledging property to the lender, but they serve different financial purposes and are subject to varying interest rates in India.

Home Loans can be utilised for enhancing your property through renovations or adding extensions. Given their lower interest rates compared to personal loans, they are a cost-effective option for home improvement financing.

Axis Bank offers Home Loans up to ₹5 crore. Check your eligibility with the Home Loan Eligibility Calculator to understand the potential loan amount available to you.

Upon submission of the requisite documents, Axis Bank typically sanctions a Home Loan within five business days, enabling a swift start to your home financing journey.

A Home Loan Balance Transfer enables you to shift the outstanding loan amount to a different lender, often for a lower interest rate or a longer repayment term. This strategy can result in reduced interest costs and better financial management. Additionally, you might have the option to obtain further financing through a top-up loan during the balance transfer process.

Salaried applicants must provide their latest salary slips, Form 16, bank statements, and KYC documents, which include proof of identity, address, and income. Employers' certification may also be required to validate employment status and income details.

The processing fee for a Home Loan is a one-time charge, up to 1% of the loan amount. This fee covers the administrative costs incurred during the loan application process.

If your Home Loan application is rejected, review the reasons, rectify credit score issues, manage existing debts, and ensure accuracy in your application. Re-assess your financial status and consider reapplying with improved eligibility or seek alternative lenders.

Enhance your Home Loan eligibility by maintaining a strong credit score, having a stable job history, reducing existing debts, and saving for a higher down payment. Consistent income and a low debt-to-income ratio also strengthen your application.

Fixed-rate Home Loans have a constant interest rate throughout the tenure, providing payment stability. In contrast, floating-rate loans have an interest rate that varies with market conditions, offering the possibility of lower rates over time but with less predictability.

To avail of a Home Loan without an ITR, Axis Bank requires alternative documents demonstrating your income and creditworthiness. This could include recent salary slips, bank statements, and employment proof for salaried individuals. For self-employed individuals, other forms of financial documentation may be required, such as profit and loss statements or audited balance sheets

It is not typically possible to get a Home Loan with absolutely no documents as lenders need to verify your identity, income, creditworthiness, and the details of the property you wish to purchase. Some form of documentation will always be required.

To reduce your Housing Loan EMIs,you might consider submitting income documents that showcase increased earnings or financial stability. This could potentially qualify you for better loan terms, including lower interest rates. A higher income demonstrated through documents like salary slips or an increased salary can lead to lower EMIs.

The language of the registration document for a Home Loan should be in the official language of the state where the transaction is taking place or in English. It's important that the language used is one that all parties understand and that it adheres to legal requirements

Axis Bank has a set of essential documents required for Home Loan approval. However, the exact number of documents can vary depending on the specific circumstances of the borrower. There might be some flexibility if you have a strong banking relationship or an excellent credit history.

Axis Bank's Home Loan interest rates are determined based on the borrower's creditworthiness, represented by their Bureau Score. For salaried individuals with a score of 751 and above, the rate is 8.70%, while self-employed applicants with the same score are offered a rate of 9.10%.

Yes, Axis Bank provides a range of Home Loan interest rate options to suit various customer needs, including both fixed and floating-rate loans. This flexibility allows customers to choose an interest rate type according to their financial plans and market outlook.

The floating rate of interest on a Home Loan at Axis Bank changes in response to movements in the RBI's repo rate and other economic factors. These rates are reviewed periodically and adjusted accordingly, impacting the interest rate applied to floating-rate Home Loans.

The effective rate of interest on a Home Loan accounts for the compounding effect and includes both the base rate and the markup. It's the comprehensive cost of borrowing and can be influenced by the loan amount, tenure, and the borrower's profile. For exact numbers, it's advisable to speak with an Axis Bank representative or use online tools for an accurate calculation.

If you have a floating-rate Home Loan, the interest rate may change during the loan tenure. However, if you have a fixed-rate loan, the interest rate will remain constant throughout the tenure.

Applying for a Home Loan with Axis Bank involves certain charges in addition to the interest rate. Prospective borrowers are required to pay a processing fee, which is calculated as a percentage of the principal amount. This fee is subject to a minimum of ₹10,000 plus GST. Additionally, an initial non-refundable fee of ₹5,000 plus GST is to be paid when the application is logged.

A processing fee of up to 1% of the loan amount constitutes the primary Housing Loan Transfer Charges with Axis Bank.

Calculate your potential savings from a Home Loan balance transfer with Axis Bank's Home Loan Balance Transfer Calculator Input the specifics of your existing loan alongside the new proposed interest rate and tenure to estimate your EMI savings.

You may secure a top-up on your Home Loan when opting for a balance transfer with Axis Bank based on your eligibility.

Home Loan balance transfer interest rates align with Axis Bank's standard Home Loan rates. You can check the current rates here

You can start the process of applying for an Home loan in any of the following three ways: :

- Online by clicking here

- In person at any Axis Bank Loan Center. To find the one closest to you, please click here

- By calling our Call Center at any of these numbers click here

- SMS Home to 5676782

Yes! You can avail of an Axis Bank Home Loan from for any of the following:

- Purchase of a home.

- Construction of a home.

- Home repairs.

- Home improvements.

- Home extension

Among the multiple factors that Axis Bank considers in determining Home Loan eligibility are:

- Income of all applicants.

- Age of the primary applicant.

- Number of dependents that the applicants have to support.

- Assets and liabilities of the applicants.

- Stability and continuity of the primary applicant's occupation.

To check your eligibility online, please click here

Yes! Axis Bank offers both Fixed and Floating rates as explained below:

Fixed Home Loan rates: The rate of interest applicable for the Home Loan is fixed throughout the term of repayment of Loan. Floating Home Loan rates: The rate of interest applicable for the Home Loan changes with change in the Bank's Base Rate/ Repo Rate.

For more details on interest rates offered by Axis Bank , please click here

The Home Loan floating rate will change when either of below rate changes:

- IRepo Rate change on the reset date for loans sanctioned from 1st October’19

- Axis Bank's Marginal cost of lending rate (MCLR) change on the reset date for loans sanctioned from 1st April, 2016

- Axis Bank's Base Rate (BR) for loans sanctioned from 1st July, 2010

- Axis Bank's Mortgage Reference Rate (MRR) for loans sanctioned before 1st July, 2010

Axis Bank reassesses the BR and MRR from time to time after considering numerous factors including the cost of funds, cost of operations, prevailing interest rates, and provisioning requirements.

Yes, it is mandatory to have a co-applicant. If someone is the co-owner of the property in question, it is necessary that he/she also be the co-applicant for the Home Loan. If you are the sole owner of the property, any member of your immediate family can be your co-applicant.

For the List of Documents to be submitted along with your Home Loan application, please by clicking here

Once we receive a completed application form along with the necessary supporting documents two things happen:

- Determination of your eligibility for the Home Loan:For this we consider our internal policy guidelines and also examine all the documents submitted by you. If you are deemed eligible, you will get an approval for a specific loan amount based on your requirement, repayment capability and the value of the property.

- Legal and Technical verification: Lawyers and property valuers empanelled by the Bank will verify your title documents conduct a technical evaluation of the property.

Axis Bank will convey its decision within 30 working days from the date of receipt of the application provided the application is complete. The computation of 30 days shall starts from the day on which all documents required for a proper appraisal of the application are provided by the Customer to bank.

If we find we are unable to extend the loan to you, we will communicate the same to you promptly.

Once both these are complete, the Bank will process the disbursement of your Home Loan.

Yes. Total Processing fees of 1% of the outstanding principal with a minimum of Rs. 10,000 plus GST as applicable will be charged. Upfront processing fee of Rs 5000 plus GST shall be collected at the time of application login. This fee will not be refunded under any circumstances such as loan rejection/withdrawal of the loan application etc., non disbursement of loan for the reasons solely attributable to the customer. Balance processing fee as applicable shall be collected at the time of loan disbursement.

To check the schedule of charges associated with transactions, click here

Pre-EMI interest is the interest on the loan amount disbursed by the bank. It is payable every month from the initial date of disbursement until the commencement of the EMI payments.

The EMI consists of the principal amount and the interest on the balance outstanding. It is calculated by taking into account the loan amount, the time frame for repaying the loan and the interest rate on the borrowed sum. The EMI may be subject to change when interest rate changes or a part-payment of the Loan is made.

Every month, part of the EMI is adjusted towards the interest payable and the balance is adjusted towards repayment of the principal.

Yes! The EMI consists of the principal amount and the interest on the balance outstanding amount. Since only a part of your loan has been disbursed, the interest component of your EMI will be proportionately lower to reflect this.

The EMI will be due on a fixed date each month. This date will be notified when your loan is disbursed.

Yes! You can switch from a floating rate of interest to a fixed rate of interest and vice versa.

| Charges for changing from fixed to floating rates of interest | Charges for changing from floating to fixed rates of interest | Charges for Higher Fixed Rate to Lower Fixed Rate | Charges for Higher Floating Rate to Lower Floating Rate |

|---|---|---|---|

| 2% of the outstanding Loan amount | 1% on the outstanding principal with a minimum of Rs.10,000/- | 0.5% on outstanding principal with minimum Rs.10,000/- | 0.5% on outstanding principal with a minimum of Rs.10,000/- |

*Goods and Services Tax (GST) will be charged extra as per the applicable rates, on all the charges and fees (wherever GST is applicable).

This option can be exercised 3 times during the tenor of your loan as per the bank’s approved policy, effective 01 Jan 2024.

Please visit your nearest loan centre to execute the supplementary agreement along with signature of all the borrowers carrying Photo ID and Signature proofs.

Each Home Loan applicant's EMI is decided upon his/her repayment capability. In order to enable us to reassess your EMI, you will need to submit the following documents at an Axis Bank Loan Center:

- Last 3 months' salary slip.

- Last 6 months' bank statements reflecting your salary.

- Your photo identity and address proof.

- A letter requesting the change

Currently, Axis Bank levies no charge to increase the EMI.

In order to avoid burdening you with a higher EMI, when the rate increased, Axis Bank would have first attempted to increase the tenure of the loan subject to permissible limits. If, however, despite the increase in tenure, the EMI is not adequate to cover the interest payment, then we are entitled to increase your EMI amount.

To reduce your EMI, we recommend making a part prepayment at your nearest Axis Bank Loan Center.

For any query on part prepayment, please write to us on: [email protected]. You may also reach us at our Call Center by dialing any of these toll free numbers click here for reach at our Call Center by dialing any of these toll free numbers..

Axis Bank's PAN is AAACU2414K and its registered office address is Axis Bank Limited, TRISHUL, Third Floor, Opp. Samartheshwar Temple, Nr. Law Garden, Ellisbridge, Ahmedabad - 380 006

- Download the Axis Mobile Application or log onto Internet Banking to get access to all account details pertaining to the loan.

- SMS MBANK to 5676782 to download the Axis Mobile App.>

You may repay your Home Loan in any of the following two ways:

i. Standing Instruction (SI): This mode can be used if you have an existing Savings, Salary, or Current Account with Axis Bank. You may wish to open a Savings account with Axis Bank to use this option. Your EMI amount will be amount debited automatically at the end of the monthly cycle from the Axis Bank account you specify.

ii. National Automated Clearing House (NACH): This mode can be used if you have a non-Axis Bank Account and would like your EMIs to be debited automatically at the end of the monthly cycle from this account.

Please submit your fresh set of post-dated cheques at your nearest Axis Bank Loan Center.

Yes, you can make a part-prepayment towards your Home Loan at your nearest Axis Bank Loan Center. If you are on a floating interest rate, no charge will be applicable. If you are on a fixed rate of interest, please check the charge applicable by

You may update your mobile number and email address in either of the following ways:.

- By calling our Call Center at any of these numbers: 1860 419 5555 or 1860 500 5555.

- Visit www.axisbank.com/support.

- You can update you email ID by using Axis Bank Mobile App.

If your new mailing address is the same for which the loan has been taken, you may change the address in either of the following ways:

- You can visit us in person at your nearest Axis Bank Loan Center along with an original and self-attested copy of your new address proof and photo identity.

- By using Axis Mobile App > Menu > Insta Services.

Before we process a foreclosure, all outstanding dues must be cleared. So we request you to first check for and clear any remaining amount that may be payable towards your Home Loan by requesting a foreclosure statement from your nearest Axis Bank Loan Center.

Once all outstanding dues have been cleared, please submit a foreclosure request at the Loan Center, and we will begin processing your request. To check the charge applicable for the foreclosure, please click here

For any query on part prepayment, please write to us on: [email protected]. You \may also reach us at our Call Center by dialing any of these toll free numbers click here for reach at our Call Center by dialing any of these toll free numbers..

Property papers will be handed over to you at Axis Bank Loan center within 15 days from the date of repayment of all dues.

MCLR stands for Marginal Cost of Funds based Lending Rate.

MCLR is the benchmark rate below which the banks cannot provide loans to the customers who are availing loans linked to MCLR. This new benchmark rate is applicable for new loans sanctioned & credit limit renewed from April 1, 2016 onwards.

For any query on part prepayment, please write to us on: [email protected]. You \may also reach us at our Call Center by dialing any of these toll free numbers click here for reach at our Call Center by dialing any of these toll free numbers..

Currently, the Bank has published the following MCLR:

In order to avoid burdening you with a higher EMI, when the rate increased, Axis Bank would have first attempted to increase the tenure of the loan subject to permissible limits. If, however, despite the increase in tenure, the EMI is not adequate to cover the interest payment, then we are entitled to increase your EMI amount.

To reduce your EMI, we recommend making a part prepayment at your nearest Axis Bank Loan Center.

For any query on part prepayment, please write to us on: [email protected]. You \may also reach us at our Call Center by dialing any of these toll free numbers click here for reach at our Call Center by dialing any of these toll free numbers..

In order to avoid burdening you with a higher EMI, when the rate increased, Axis Bank would have first attempted to increase the tenure of the loan subject to permissible limits. If, however, despite the increase in tenure, the EMI is not adequate to cover the interest payment, then we are entitled to increase your EMI amount.

To reduce your EMI, we recommend making a part prepayment at your nearest Axis Bank Loan Center.

For any query on part prepayment, please write to us on: [email protected]. You \may also reach us at our Call Center by dialing any of these toll free numbers click here for reach at our Call Center by dialing any of these toll free numbers..

In order to avoid burdening you with a higher EMI, when the rate increased, Axis Bank would have first attempted to increase the tenure of the loan subject to permissible limits. If, however, despite the increase in tenure, the EMI is not adequate to cover the interest payment, then we are entitled to increase your EMI amount.

To reduce your EMI, we recommend making a part prepayment at your nearest Axis Bank Loan Center.

For any query on part prepayment, please write to us on: [email protected]. You \may also reach us at our Call Center by dialing any of these toll free numbers click here for reach at our Call Center by dialing any of these toll free numbers..

In order to avoid burdening you with a higher EMI, when the rate increased, Axis Bank would have first attempted to increase the tenure of the loan subject to permissible limits. If, however, despite the increase in tenure, the EMI is not adequate to cover the interest payment, then we are entitled to increase your EMI amount.

To reduce your EMI, we recommend making a part prepayment at your nearest Axis Bank Loan Center.

For any query on part prepayment, please write to us on: [email protected]. You \may also reach us at our Call Center by dialing any of these toll free numbers click here for reach at our Call Center by dialing any of these toll free numbers..

In order to avoid burdening you with a higher EMI, when the rate increased, Axis Bank would have first attempted to increase the tenure of the loan subject to permissible limits. If, however, despite the increase in tenure, the EMI is not adequate to cover the interest payment, then we are entitled to increase your EMI amount.

To reduce your EMI, we recommend making a part prepayment at your nearest Axis Bank Loan Center.

For any query on part prepayment, please write to us on: [email protected]. You \may also reach us at our Call Center by dialing any of these toll free numbers click here for reach at our Call Center by dialing any of these toll free numbers..

In order to avoid burdening you with a higher EMI, when the rate increased, Axis Bank would have first attempted to increase the tenure of the loan subject to permissible limits. If, however, despite the increase in tenure, the EMI is not adequate to cover the interest payment, then we are entitled to increase your EMI amount.

To reduce your EMI, we recommend making a part prepayment at your nearest Axis Bank Loan Center.

For any query on part prepayment, please write to us on: [email protected]. You \may also reach us at our Call Center by dialing any of these toll free numbers click here for reach at our Call Center by dialing any of these toll free numbers..

In order to avoid burdening you with a higher EMI, when the rate increased, Axis Bank would have first attempted to increase the tenure of the loan subject to permissible limits. If, however, despite the increase in tenure, the EMI is not adequate to cover the interest payment, then we are entitled to increase your EMI amount.

To reduce your EMI, we recommend making a part prepayment at your nearest Axis Bank Loan Center.

For any query on part prepayment, please write to us on: [email protected]. You \may also reach us at our Call Center by dialing any of these toll free numbers click here for reach at our Call Center by dialing any of these toll free numbers..

In order to avoid burdening you with a higher EMI, when the rate increased, Axis Bank would have first attempted to increase the tenure of the loan subject to permissible limits. If, however, despite the increase in tenure, the EMI is not adequate to cover the interest payment, then we are entitled to increase your EMI amount.

To reduce your EMI, we recommend making a part prepayment at your nearest Axis Bank Loan Center.

For any query on part prepayment, please write to us on: [email protected]. You \may also reach us at our Call Center by dialing any of these toll free numbers click here for reach at our Call Center by dialing any of these toll free numbers..

In order to avoid burdening you with a higher EMI, when the rate increased, Axis Bank would have first attempted to increase the tenure of the loan subject to permissible limits. If, however, despite the increase in tenure, the EMI is not adequate to cover the interest payment, then we are entitled to increase your EMI amount.

To reduce your EMI, we recommend making a part prepayment at your nearest Axis Bank Loan Center.

For any query on part prepayment, please write to us on: [email protected]. You \may also reach us at our Call Center by dialing any of these toll free numbers click here for reach at our Call Center by dialing any of these toll free numbers click here

Yes, resident Indians are eligible for tax benefits on both the principal and the interest of a Home Loan under the Income Tax Act. Please consult your tax advisor for details.

IAxis Bank's PAN is AAACU2414K and its registered office address is Axis Bank Limited, TRISHUL, Third Floor, Opp. Samartheshwar Temple, Nr. Law Garden, Ellisbridge, Ahmedabad - 380 006

- Download the Axis Mobile Application or log onto Internet Banking to get access to all account details pertaining to the loan.

- SMS MBANK to 5676782 to download the Axis Mobile App.

You may repay your Home Loan in any of the following two ways:

i. Standing Instruction (SI): This mode can be used if you have an existing Savings, Salary, or Current Account with Axis Bank. You may wish to open a Savings account with Axis Bank to use this option. Your EMI amount will be amount debited automatically at the end of the monthly cycle from the Axis Bank account you specify.

ii. National Automated Clearing House (NACH): This mode can be used if you have a non-Axis Bank Account and would like your EMIs to be debited automatically at the end of the monthly cycle from this account.

Please submit your fresh set of post-dated cheques at your nearest Axis Bank Loan Center.

Yes, you can make a part-prepayment towards your Home Loan at your nearest Axis Bank Loan Center. If you are on a floating interest rate, no charge will be applicable. If you are on a fixed rate of interest, please check the charge applicable byclicking here

- By calling our Call Center at any of these numbers: 1860 419 5555 or 1860 500 5555.

- Visit www.axisbank.com/support.

- You can update you email ID by using Axis Bank Mobile App.

If your new mailing address is the same for which the loan has been taken, you may change the address in either of the following ways:

- You can visit us in person at your nearest Axis Bank Loan Center along with an original and self-attested copy of your new address proof and photo identity.

- By using Axis Mobile App > Menu > Insta Services.

Before we process a foreclosure, all outstanding dues must be cleared. So we request you to first check for and clear any remaining amount that may be payable towards your Home Loan by requesting a foreclosure statement from your nearest Axis Bank Loan Center.

Once all outstanding dues have been cleared, please submit a foreclosure request at the Loan Center, and we will begin processing your request.

To check the charge applicable for the foreclosure, please click here

Property papers will be handed over to you at Axis Bank Loan center within 15 days from the date of repayment of all dues.

MCLR stands for Marginal Cost of Funds based Lending Rate.

MCLR is the benchmark rate below which the banks cannot provide loans to the customers who are availing loans linked to MCLR. This new benchmark rate is applicable for new loans sanctioned & credit limit renewed from April 1, 2016 onwards.

Currently, the Bank has published the following MCLR:

- Overnight MCLR

- One-month MCLR

- Three-month MCLR

- Six month MCLR

- One year MCLR

- Two year MCLR

- Three year MCLR

The benchmark MCLR for Axis Home/ LAP loans is 6 months. The reset period would be every 6 months.

The MCLR will be a tenor linked rate which has to be reviewed and published every month on a pre-announced date For the existing AXIS Bank MCLR rate please click here.

Yes, MCLR can be different between different banks as it will depend on marginal cost of funds, negative carry on account of CRR, operating costs, tenor premium of respective banks.

The Reserve Bank of India (RBI) vide its circular no DBR.DIR.BC.No.14/13.03.00/2019-20 on “External Benchmark Based Lending” dated September 04, 2019 and RBI vide circular no. DBR. Dir. No.85/13.03.00/2015-16 on “Interest Rate on Advances” dated March 03,2016 , updated as on September 04,2019 has advised to link all new floating rate personal or retail loans (housing, auto, etc.) and floating rate loans to Micro and Small Enterprises extended by banks with effect from October 01, 2019 to external benchmark which can be one of the following:

- Reserve Bank of India policy repo rate

- Government of India 3-Months Treasury Bill yield published by the Financial Benchmarks India Private Ltd (FBIL)

- Government of India 6-Months Treasury Bill yield published by the FBIL

- Any other benchmark market interest rate published by the FBIL. In line with the above circular, Axis Bank has adopted Repo rate as the external Benchmark lending rate with effect from October 01, 2019.

No, Repo Rate is being determined by Monetary Policy published by Reserve Bank of India

All floating rate loans sanctioned by the Bank with effect from 1st October 2019 are linked to the REPO rate. The rate of interest offered to you for your loan shall be the REPO rate plus spread. Any movement in the REPO rate shall result in your loan being reprised accordingly. For Bank level: - REPO rate would be published on a monthly basis.

For customer level: REPO rate would remain the same till REPO rate reset date. The reset frequency for mortgage loans linked to REPO rate would be once in three months or as decided by the Bank, whichever is earlier. The Bank shall have absolute right to decide and apply the spread over the Repo Rate, ”Spread” shall consist of credit risk premium (which is subject to change in case there is substantial change in your credit assessment as agreed in the loan agreement), operating costs and other costs. The spread will be reset periodically once in three years from the date of first disbursement. Your credit risk premium shall be reviewed by the Bank at regular intervals and shall undergo a revision in case of a substantial change in your credit assessment.

All floating rate loans will be linked to REPO rate. The rate of interest offered to you for your loan shall be the aggregate of REPO rate plus spread. It may be noted that the REPO rate would be reset every three months or as decided by the Bank, whichever is earlier.

Further, the Bank shall have absolute right to decide and apply the spread over the REPO rate, ”Spread” shall consist of credit risk premium (which is subject to change in case there is substantial change in your credit assessment as agreed in the loan agreement), operating costs and other costs. The spread will be reset periodically once in three years from the date of disbursement. Your credit risk premium shall be reviewed by the Bank at regular intervals and shall undergo a revision in case of a substantial change in your credit assessment.

Bank will publish the REPO rate every month on a pre-announced date. The REPO rate applicable to you would be the prevailing repo rate for that month.

For all loans linked to REPO rate, the reset frequency would be three months or as decided by the Bank, whichever is earlier.

Yes, you can at mutually acceptable terms with the Bank.

Banks can specify dates of interest reset which will be linked to either the date of first disbursement or date of review of MCLR/ REPO rate. The MCLR/ REPO rate prevailing on the day the loan is disbursed will be applicable till the next reset date, irrespective of the changes in the MCLR / REPO rate in the interim. For all loans linked to REPO rate, the reset frequency would be three months or as decided by the Bank, whichever is earlier. For example: the Home Loan/ LAP loans disbursed in the month of November 2019, would be due for reset in the month of February 2020 similarly all such loans disbursed in the months of December 2019 would be due for reset in the month of March 2020 and so on, unless there is a change in the Bank’s guidelines in which case the reset would occur as and when there is such change in the Bank’s guidelines.

The reset period and date will be decided on the date of first disbursement.

In case of increase in MCLR on the reset date, the ROI will increase which in turn will impact the EMI/tenor of the loan as per Bank’s policy and will be communicated to the customer.

In case of decrease in MCLR on the reset date, the ROI will decrease which in turn will impact the EMI/tenor of the loan as per Bank’s policy and will be communicated to the customer.

It may be mentioned that the spread/margin of the loan would continue to remain the same.

Illustration: Consider a scenario where first disbursement of the loan is done on April 15, 2016 under MCLR-6 month’s benchmark rate, with the 6 months MCLR being 9.20% p.a. with a spread/margin of 20 basis points (bps). In such a case the effective rate would be 9.40% p.a.

In the above scenario, the effective rate of 9.40% p.a. would remain constant till the next reset date i.e Oct 2016.

On Oct 2016, the loans would be reset with the applicable 6 months MCLR rate as on that date.

It may be mentioned that the spread/margin of the loan would continue to remain the same. e.g. If the 6 months MCLR is 9.10% p.a. as on OCT 2016, then revised rate applicable for the loan would be 9.10% + 0.20% = 9.30% p.a. w.e.f. Oct 2016.

The Bank will inform you if there is a change in rate of interest due to a reset of the REPO rate as and when such change is affected in your loan account via SMS alert on your registered mobile, The consequential change impact would initially be made to the loan tenure i.e. the loan tenure will be increased; however if maximum tenure of the loan has already been availed, then the EMI would have to be modified and the revised EMI will be intimated to you

All existing loans linked to Base Rate/ MCLR will continue till its repayment. All existing Borrowers will however have the option to shift to the Repo Rate linked loan at mutually acceptable terms. Thus, in case of partly disbursed loans, for subsequent disbursements, the Base Rate/MCLR will continue to be applicable, provided the Borrower does not exercise the option to move to the Repo Rate linked loan at mutually acceptable terms

(BR= Base rate, MRR= Mortgage reference rate, BPLR = Bank prime lending rate)

For all new loans sanctioned from October 1, 2019, the Bank has discontinued offering loans linked with Base Rate/MRR/BPLR/MCLR. However, the existing loans will continue on the respective BR/MRR/BPLR/MCLR till its repayment, provided the borrower does not exercise the option to move to the Repo Rate linked loan at mutually acceptable terms

For changing from existing bench mark rate of BR/MRR/BPLR/MCLR to Repo Rate based benchmark rate, the customer will be required to visit the nearest loan center, execute an agreement for conversion into Repo Rate based benchmark.

If customer is on MRR/BPLR/Base Rate/MCLR, customer can request to move to Repo Rate by paying an administrative fee to the Bank. Hence, the benchmark rate and spread might undergo a change as per the customer’s request

No, there is no option to move back from REPO RATE to Base rate/BPLR/MRR/MCLR

YES, Base rate/MCLR will be reviewed by the Bank from time to time and it may or may not change

Applicable REPO RATE for each month will be updated on Axis Bank Website

You will come to know through our Website / SMS / Email/ letter as deemed fit

Customers will have the option to get the disbursement either on MCLR or Repo Rate

All fresh loans disbursed in a particular month shall be linked to that month’s REPO RATE, irrespective of the month of sanction. Example –Sanction Month – October, Disbursement month- November. Applicable REPO RATE- November REPO RATE

YES, you can continue as long as you want to continue on MRR/BPLR/Base Rate/MCLR. It will be converted to REPO RATE only once you request to do so

The provision IT Certificate would be generated as per the prevailing Repo Rate

Any pre-payment/excess amount paid by you to the Bank; shall be appropriated in the loan account basis the below criteria/methodology in the absence of any specific instructions from you:

- Excess amount greater than (>) EMI: If service request (SR) for part payment is not created/received within 2 days of receipt of funds, the excess funds will be adjusted towards principal outstanding as part payment.

- Excess amount equal to (=) EMI: If service request (SR) / instructions for part payment is not created/received on same day of receipt of funds, excess amount will be refunded to your operative account.

- Excess amount less than (<) EMI: Excess amount will be kept unappropriated in the Loan account for 15 days. Post 15 days, the excess funds shall be adjusted towards principal outstanding as a part payment.

- Excess amount equal to (=) or greater than (>) foreclosure / pre-closure amount : In case no instructions are placed by you at the Loan Centre / Phone Banking within 3 working days from the date of credit in Loan account and:

- Excess amount is equivalent (=) to the foreclosure amount, Loan account will be proactively closed by the Bank.

- Excess amount is greater than (>) the foreclosure amount, adjustment in Loan account would be as follows:

- If excess amount is up to INR 20,000, Loan account would be closed by the Bank and after closure, excess funds would be credited to the Loan repayment account.

- If excess amount is greater than INR 20,000, the Bank will connect with you telephonically for verification of payment. Alternatively, you may connect with the Bank on 18604195555 to confirm the credit adjustment in your Loan account.

- Excess amount less than (<) the foreclosure amount: In case no instructions are placed by you at the Loan Centre / Phone Banking within 3 working days from the date of credit in Loan account, then excess amount will be adjusted against the outstanding principal, leaving an amount equivalent to one EMI for forthcoming EMI presentation. However, in case you would like the entire amount to be adjusted against the outstanding principal, please place a request at Phone Banking / Loan Centre at the earliest.

Unlearn

There are many variations of passages of Lorem Ipsum available but the majority have suffered alteration in some form.

Building a savings habit simplified with 5 easy steps

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

6 things to consider before opening a Savings Account

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Opening a savings account via video KYC

Lorem Ipsum is simply dummy text of the printing and typesetting industry.